This past month was a doozy in the markets and I saw a rather significant dip in my net worth as a result. I am now a few months into my sabbatical after quitting when my employer suddenly forced everyone back into the office. When I left that job, I received a cash payout for all of my accrued vacation hours that equaled a little over 2 months worth of wages, that if I carried forward means September was the first month I was wageless. It’s kind of shocking to think about how I had been working so much with no ability to take a vacation that I had more than two full months of paid leave when I left. But now that the “severance” payment has run its course, I’m solidly in the no-income phase of my sabbatical.

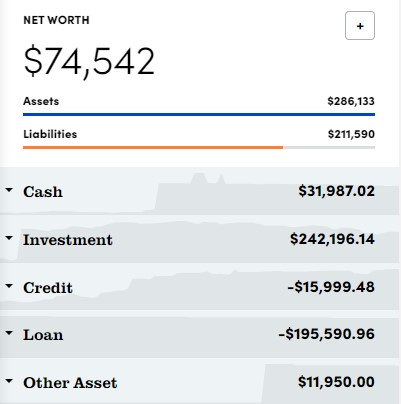

Let’s have a look at where my net worth settled on October 1st:

Net Worth = Assets minus Liabilities

| Assets | Amount | Change from Last Month |

| Checking/Savings | $31,987 | |

| Retirement Accounts | 188,671 | |

| Taxable/Nontax Investments | 53,525 | |

| Misc. (Gold/Silver/Cash/Collectibles) | 11,950 | |

| Total Assets | 286,133 | -16,729 |

| Liabilities | Amount | Change from Last Month |

| Credit Cards | $15,999 | 0% interest rate. |

| Student Loans | 195,591 | |

| Total Liabilities | 211,590 | +7 |

Net Worth = $74,542

Change in Net Worth from last month: -$16,736

Total Change in Net Worth Since July 2020: +$122,770

Net Worth Summary

Almost the entire drop in asset value this month was in my investment accounts where I saw my investments in oil and gas companies drop especially hard. Incidentally, they have rallied 40% during the month of October so this update is a bit out of date. I’m also still holding a large percentage of cash in my investment accounts that I plan to deploy in the coming months to take advantage of a declining stock market. Holding this large cash balance in 2022 has proven very effective and puts my YTD return at about 15 percentage points higher than the S&P 500. I am expecting to buy back in at depressed prices and ride the growth back up as we emerge from the lows as the Federal Reserve begins tapering the interest rate increases in early 2023.

I may also see a $20,000 increase in net worth as a result of the pending Student Loan Forgiveness program being rolled out by the current Administration. It is under a temporary legal stay while issues are worked out, but I expect it will eventually go through. This forgiveness will change my net worth value, but doesn’t really impact my situation at all since I qualify for Public Service Loan Forgiveness with another five years of government or non-profit service anyway. If my income remains zero in January, my monthly student loan payment will be reduced to zero as well. With the new repayment plan being expected to rollout in 2023, it will also ensure that no unpaid interest would accumulate on the loan as well.

Now that I’m solidly in the no-income phase, I am living off of my emergency cash savings which currently totals about $32,000. Part of that cash savings is earmarked for repaying the 0% credit card balances in late 2023. I could also tap about $4,000 in a Health Savings Account, but I am choosing to keep that as an investment balance. I have reduced my living costs and have taken to house and pet sitting to help accomplish that goal. I’m not sure how long I will be taking time off, so this is a great way to keep my monthly expenses at around $1,000 while I figure things out. In the grand scheme of things, I lived quite frugally before leaving my job so things haven’t changed much in my life. With prices soaring, I’ve been limiting my dining out unless, I find a great deal, and I tend to avoid the accumulation of material possessions because of my nomadic ways. This combination of behaviors leads to a naturally low cost of living.

Leave a Reply