I’ve been a follower of Suze Orman for years and really appreciate her “no nonsense” approach to dishing out financial advice. Suze was interviewed for a piece on CNBC.com the other day, “Suze Orman: A perfect financial storm is brewing and it is worse than 2008” and it takes a very sobering look at the current economic environment and what people should be doing to prepare for things to get worse with unemployment. It’s not surprising that many people were financially unprepared to face the economic impact of the COVID-19 pandemic.

Suze has long advocated for people to work toward building up an eight month emergency fund in order to insulate themselves from the kind of economic armageddon we are experiencing here in the United States. Her advice was not very popular among many, but in light of the current long-term unemployment situation and the lack of government support for those most vulnerable to job losses, it is proving very prescient. Now, Suze is encouraging people to focus entirely on building up that emergency fund in order to brace for additional economic hardship that could be on the horizon.

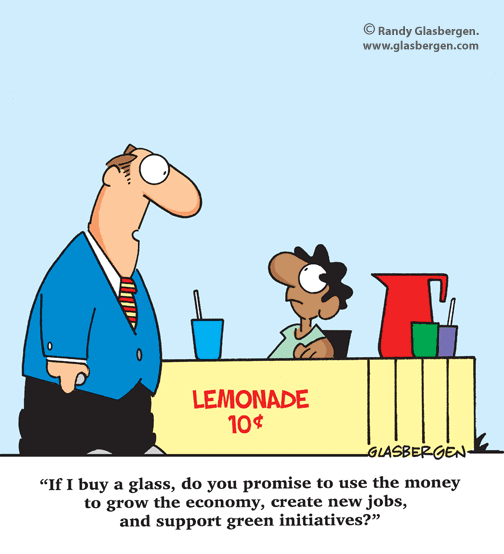

As an Economist by trade, there is a particular piece of advice that Suze is emphasizing now that from a Micro point of view, is great advice for the individual but, from the Macro view, could significantly deepen the economic damage currently underway – that advice is to cease all non-essential household spending (in order to put it all in emergency savings). As someone who is frugal by nature, I understand how powerful it can be for retirement savings and personal financial goals to spend less on non-essentials. But as an Economist, I also know that if everyone in America followed Suze’s advice, the economy would enter a deep Depression. Every restaurant and non-essential retailer in the country would close and force millions of restaurant and retail workers out of jobs, which would then have a ripple effect through every other industry since we are so economically interconnected.

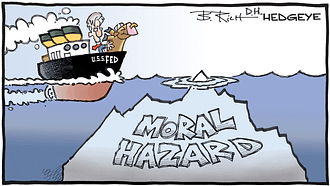

Moral Hazard

What I’m about to say will be an extremely unpopular statement, but we need those frivolous spenders to keep doing what they do in order to keep the economy chugging along. What that creates is the opportunity for those of us without those spending proclivities to benefit from a strong economy by investing our savings in the companies that they blow their paychecks at. The problem is that it creates a moral hazard in that those spendthrifts require a financial bailout (just like “too big to fail corporations” did) in order to not end up homeless due to their lack of an emergency fund or other financial preparation for a recession.

What I’m about to say will be an extremely unpopular statement, but we need those frivolous spenders to keep doing what they do in order to keep the economy chugging along. What that creates is the opportunity for those of us without those spending proclivities to benefit from a strong economy by investing our savings in the companies that they blow their paychecks at. The problem is that it creates a moral hazard in that those spendthrifts require a financial bailout (just like “too big to fail corporations” did) in order to not end up homeless due to their lack of an emergency fund or other financial preparation for a recession.

Now, I’m not talking about those who are earning a below-living wage (mostly in essential occupations) and struggling just to survive who deserve every bit of help they are getting, and more; I’m talking about the middle and high-income folks with two earners, a large house, two car payments, who dine out five nights a week and take multiple vacations each year and have no savings. Suddenly the economy takes a turn for the worse and one or both of the incomes evaporate via layoffs and this household is immediately on the brink of foreclosure, car repossession, and maxing out credit cards just to put food on the table.

What should we do about it?

Therein lies the problem. How do we ensure a stable economy via strong consumer spending while at the same time ensuring that those spendthrifts save for a rainy day? Is it even possible? This probably isn’t the place for me to publish a behavioral economics study of this exact question, but the simple answer is that there will always be spendthrifts who are going to spend their paycheck as soon as it comes in, but they become completely dependent on the generosity of others (or the government) when things go wrong. This is the antithesis of the Financial Independence/Retire Early (FIRE) movement. The moral hazard exists because they feel confident that they will eventually get bailed out… but what if someday the bailout never comes?

Forget about the money for a moment and realize that the true power of FIRE is the “I” – Independence. Achieving financial independence means that you don’t have to be dependent on anyone else when things get rough. Rather than get angry or frustrated at those who spend all their money on useless things or are living above their means, I try to enjoy feeling the weight off my shoulders knowing that I don’t have to depend on a bailout to feed myself or keep a roof over my head if something bad happens – and thank them for spending all their money on a Chipotle habit while my shares in the company continue to soar in value. That’s the power of financial freedom and FIRE… knowing that everything will be okay because you’re in the driver’s seat of your financial life.

Leave a Reply