As of 2020, there is over $1.5 Trillion in federal student loans, owed by 45 million current and former higher education students. Out of those 44 million borrowers, there are currently 1,195,497 who are enrolled in the Public Service Loan Forgiveness (PSLF) program. PSLF was created to provide an incentive for graduates to work in the government or non-profit sectors, where salaries are typically lower, by forgiving any remaining balance on their federal student loans after making 10 years of on-time payments while working for a qualifying employer.

If you’ve read my introductory Net Worth Update, you’ll see that I started this blogging journey with $198,486 in student loan debt. All but $15,000 of that balance is in the form of federal student loans accumulated during undergraduate and graduate school. I’ve had people tell me I should prioritize paying down this debt. But prioritizing paying down this debt is simply not a fiscally prudent scenario since I qualify for PSLF through my employer. After explaining this to some people, I’ve even had them accuse me of “taking advantage” of the system or even of ripping off taxpayers… both arguments are absolutely absurd. I really got a good laugh when I stumbled across some Dave Ramsey YouTube videos of him deriding the PSLF program. Interestingly, it seems the people expressing the most hate toward PSLF are the ones who have the least understanding of the program.

Why PSLF?

What if the government wanted to encourage home ownership and revitalization in a dilapidated region of the country by agreeing to forgive your remaining mortgage if you work and live in that community for 10 years, or offering a company tax breaks to open a new factory in town? It’s the same thing that PSLF is trying to encourage – offering an incentive to encourage specific behavior. The tax code works in much the same way through the use of deductions and exemptions that are meant to encourage (or discourage) specific behavior within the population. In the case of PSLF, highly educated workers are incentivized to work in sectors that are desperately in need of great talent, but can’t afford to pay the higher salaries found in the private sector.

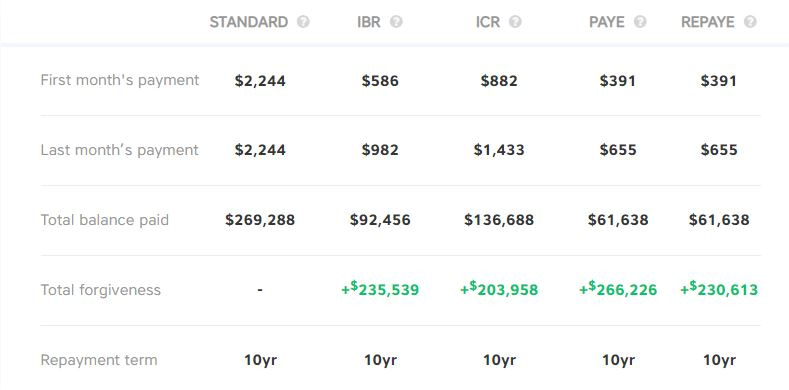

Many young lawyers and doctors are prime examples of this need for incentivization so that non-profit hospitals and legal aid clinics, for example, can attract the talent they need at a salary they can afford. In exchange, the employee commits to working for qualifying employers and makes 10 years of income-based repayments on their loans and then the remaining balance is forgiven, tax-free. In my case, depending on how much of the loan is paid down over ten years, the forgiveness translates to a tax value of approximately $65,000 and I would have paid a little over $60,000 toward the loans (mostly interest). Spreading that $65,000 tax savings across the 10 years of qualifying payments means I’m effectively earning an extra $6,500 per year with this benefit. This is exactly how I look at PSLF – additional non-cash compensation.

What’s a qualifying income-based payment?

This is one part of PSLF that seems to change at the whim of Congress. There are numerous income-based repayment plans that count toward public service loan forgiveness and they include:

Revised Pay As You Earn Repayment Plan (REPAYE)

Pay As You Earn Repayment Plan (PAYE)

Income-Based Repayment Plan (IBR)

Income-Contingent Repayment Plan (ICR Plan)

The general theme here is that each of these plans ties your monthly student loan payment to a certain percentage of your “discretionary income.” The Department of Education defines “discretionary income” as adjusted gross income subtracted by 150% of the poverty guideline for your family size. I find this method rather misleading since discretionary income to most people would mean what is left after paying for the necessities of life, such as rent, transportation, food, etc. The necessities of life have vastly different costs across the country and the discretionary income calculation does not take that into account (except for those that live in Alaska or Hawaii who get a slightly higher poverty line for some reason).

After calculating the discretionary income, you then pay a percentage of that toward your student loans each month, the range is currently 10-20%. Due to the pandemic, these payments (and accruing interest) have been frozen through the end of 2020, but the months will still count toward fulfilling the requirements of PSLF.

Reducing discretionary income and maximizing retirement savings

When thinking about the marginal tax rate that I pay, I tend to include the 10% student loan payment in the calculation. The marginal rate is the rate paid on the last dollar of income. For instance, if you are a single person with taxable income of $50,000, then your marginal tax rate is 22%. However, because our tax system in the United States uses brackets, not all of your $50,000 is taxed at 22%. In fact, the first $9,875 of taxable income is only taxed at 10%, then the next $30,250 at 12%. The reason I consider the 10% student loan payment a tax is because it is directly tied to my income just like federal and state income taxes and because the loan will be forgiven in the future. This also considers that the loan balance is so large that early payoff is much more costly than making income-based payments for 10 years.

Lowering Your Taxes

When considering retirement contributions, it’s important to know what your marginal tax rate is to determine how much you are saving in taxes today by putting money away for retirement in the future. Because of these student loan payments, I get an even larger tax break for contributing to a 401k and/or IRA. In fact, my marginal tax rate (before making any retirement contributions) is 22% federal, 8.5% state, and 10% student loan, for a total of 40.5%. This means that for every dollar I am able to contribute to a tax-deferred retirement plan, I am saving 40.5 cents in taxes today. This makes maxing out retirement contributions a very compelling option. In order to be in a 40.5% tax bracket without the student loans, I would need to make nearly $175,000.

| Federal marginal rate | 22% |

| State marginal rate | 8.5% |

| REPAYE Rate | 10% |

| Total marginal tax/IBR rate | 40.5% |

| Total annual tax/REPAYE savings @ max retirement contributions | $7,897.50 |

This is the hidden power of PSLF: lower adjusted gross income = lower payments, lower taxes, and maximized forgiveness!

PSLF is no free lunch

After making approximately $60,000 in student loan payments over the next nine years on the REPAYE plan, I will be able to file paperwork to have the remaining balance on the federal student loans forgiven. However, should I choose to stop working for a qualifying employer, there is no partial forgiveness – it’s all or nothing! But, the current program does allow you to change employers and count the time spent there toward the forgiveness threshold. This creates an incredibly strong incentive to stay in the employ of qualifying employers until after reaching 10 years of qualifying employment AND qualifying payments.

One of the frustrating things about the typical government assistance program like the Supplemental Nutrition Assistance Program, WIC, or Medicaid is that they penalize people for saving money by eventually disqualifying participation based on an annual asset test. However, with PSLF, the program is designed to effectively encourage saving money for the future via a 401k or IRA which increases the value of the government assistance (a lower income based repayment amount) and after 10 years the borrower’s debt is forgiven. If they did things right, they will also have a substantially larger retirement account balance. For this reason alone, it’s a good idea to take this benefit into consideration when applying for jobs as an indebted college graduate.

Let’s take a look at what happens in 10 years when the $230,613 of student loans are forgiven:

| 10 years of repayment | $61,638 |

| Amount Saved in 401k/IRA ($19,500/yr @ 7%) | $269,420 |

| Value of Tax-Exempt Forgiveness @ 28% tax rate | $64,572 |

Remember that in each year you can max out your retirement contributions, you are also lowering your IBR student loan payments by 10-15% of that when you re-certify your income in the next year. That means $1,950-2,925 in loan repayment savings per year for maximizing contributions to your retirement. In addition, at the end of the 10-years there will be an extra $269,420 in a tax-deferred retirement account that will continue to grow until retirement. The final figure of $64,572 is the value of the potential “tax bomb” that would be owed on the forgiven debt if Congress decides to make this forgiveness under PSLF a taxable event. This tax bill is what awaits borrowers who have their loans forgiven after 20-25 years of repayments outside of the PSLF program as the current tax code considers this forgiven debt to be taxable as income. The first borrowers to hit the 20-25 year repayment threshold on IBR plans is not going to happen for another decade or so, which means there is plenty of time for Congress to make changes to the way this non-PSLF forgiven student loan debt is taxed.

What’s the catch?

One caveat, however, is that the PSLF has been regularly eyed for “reform” due to the projected ballooning cost of the program as more qualified borrowers hit their 10-year forgiveness date. While this concern is always in the back of my mind, it is very unlikely that someone already in qualifying repayment under PSLF will not be grandfathered in under the current rules if the program were to be eliminated or curtailed for future participants. In fact, there’s been a great deal of debate on this point in several PSLF forums as to whether the inclusion of the PSLF provision in the master promissory note provides any legal protection for borrowers. If things do not go favorably for those of us planning on utilizing PSLF, it’s all the more reason to make sure you are taking advantage of saving as much as possible in a tax-deferred plan while in the income based repayment period.

3 Comments