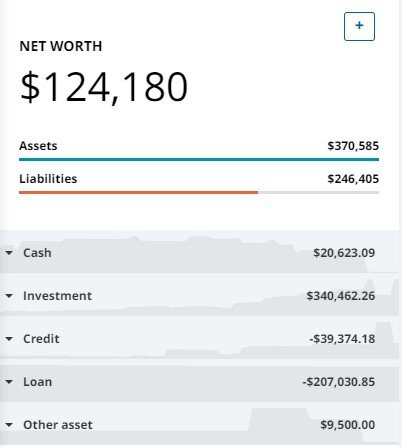

Net Worth = Assets minus Liabilities

| Assets | Amount | Change from Last Month |

| Checking/Savings | $45,623 | |

| Retirement Accounts | 201,953 | |

| Taxable/Nontax Investments | 113,509 | |

| Misc. (Gold/Silver/Cash) | 9,500 | |

| Total Assets | 370,585 |

| Liabilities | Amount | Change from Last Month |

| Credit Cards | $39,374 | 0% interest rate. |

| Student Loans | 207,031 | |

| Total Liabilities | 246,405 |

Net Worth = $124,180

Change in Net Worth from last update: $34,274

Total Change in Net Worth Since July 2020: +$172,408

Net Worth Summary

I’ve neglected two months of updates. Honestly, I don’t know where the time has gone. Somehow it’s already August and summer is almost over. I have a million ideas and plans for this blog and some other interests but I end up fully distracted by all of the day-to-day responsibilities. While I don’t have any firm work plans in place yet, I’ll continue in my grad program in the fall semester and looking for interesting opportunities. I’m not sure where things are headed with school and work, but it will be interesting to see what opportunities present themselves.

I’ve noticed that Personal Capital/Empower is a bit wonky when transferring funds between accounts. For the past couple of weeks I’ve been dealing with discrepancies because of the float between leaving one account and arriving in the next. Unfortunately, this results in big jumps and dips in the graphs and Empower doesn’t seem to be able to reconcile that the transfer between accounts shouldn’t result in any change. For that reason, I had to get a bit creative with adding a placeholder account to cover the in-transit funds for a transfer that straddled month-end.

Despite my toxic job ending about a month ago, I’ve seen some strong growth in my investment account balances. It looks like my first month after leaving the job I actually made twice as much in investment gains as my previous salary, which is always a nice thing to see.

Savings Account Interest Rates

Rates on savings accounts continue to increase as the Federal Reserve raises interest rates. My current rate is right around 4.5% and any idle cash in my investment accounts is also being put to work in a government money market fund that has a current yield slightly over 5%.

0% Interest Credit Card Arbitrage

I continue to roll my credit card arbitrage strategy with either 0% purchase or balance transfer offers. With savings rates between 4.5-5%, it’s a risk-free return versus paying off the credit cards early with no financial incentive. In my case, with the $40,000 carry on the 0% credit cards, I’m making about $150/month by borrowing the money from Amex, Capital One, and Wells Fargo and “lending” it out to a savings account. I’m further increasing this rate of return by moving the money into new accounts with a sign up bonus. This usually pays another $200 with every new savings or investment account opened. This is exactly what banks do and I might as well join the party. I keep the entire $40,000 available in liquid savings or money market accounts so it is not taking on any unnecessary debt, but is a straight arbitrage situation.

Money Sloth,

Thanks for another great posting – I like your idea about credit card arbitrage. This actually seems like a decent idea, you’d just have to be careful not to run into trouble with the credit card companies. They may have provisions that prevent the credit from being used for arbitrage or other tricky ways to extract fees from you.

Thankfully, the credit card companies don’t have much of a way to limit arbitrage since they would be oblivious to the fact I’m keeping the money saved. The primary downside is a reduced credit score due to the higher credit usage. However, I don’t have any plans for buying a house or car in the future so the credit score isn’t an issue for me. For anyone planning to finance a house or car, credit card arbitrage is certainly not a good idea. It’s also a good feeling to play the bank’s own business model against them.