For some reason, I thought that taking two accelerated grad school courses over the past month and a half was a good idea. Finding time to do anything besides work and study has been nearly impossible, but I decided to set some time aside to finally update my February net worth. For the record, I’ve learned my lesson and am cutting back my course load going forward!

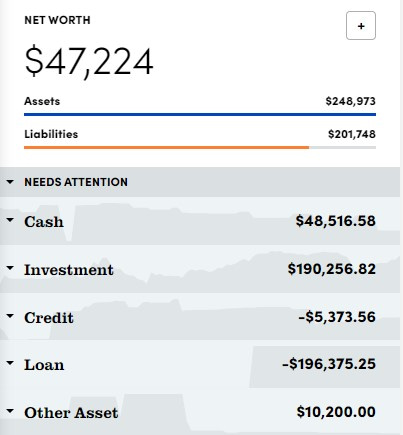

Net Worth = Assets minus Liabilities

| Assets | Amount | Change from Last Month |

| Checking/Savings | $48,517 | |

| Retirement Accounts | 170,500 | |

| Taxable Investments | 19,757 | |

| Misc. (Gold/Silver/Cash/Collectibles) | 10,200 | |

| Total Assets | 248,973 | -5,310 |

| Liabilities | Amount | Change from Last Month |

| Credit Cards | $5,374 | |

| Student Loans | 196,375 | |

| Total Liabilities | 201,748 | +3,245 |

*These values have been corrected to reflect the actual student loan balances.

Net Worth = $47,224

Change in Net Worth from last month: -$8,556

Total Change in Net Worth Since July 2020: +$95,452

Net Worth Summary

As luck would have it, I broke above the +$100,000 net worth increase last month and it was snatched back a month later. The stock market had a bit of a correction that caused the drop in investment balances and there was also a re-calculation of my student loans that added several thousand to the balance (as a result of capitalized interest after consolidating).

The market is full of ups and downs and this is simply a bump in the road. My savings rate continues to exceed 50% of my income, so I will continue to invest those funds each month and watch things continue to grow over time. I remain on track to max out my work retirement account, IRA, and HSA for 2022.

The Future of Work

As the Covid-19 pandemic has continued to evolve, the future of white collar work has been in the spotlight. My own employer continues to play a cat and mouse game regarding when to bring everyone back to the office. A recent survey of employees discovered that more than 2/3 of staff want to stay working from home full-time on a permanent basis, with more than a few saying they plan to seek other remote work opportunities if our management should require everyone to return to the office. We have been tremendously successful in achieving all of our work objectives while being 100% remote for the past two years, so it makes sense that people would feel this way.

Over the past month, I have become much more skeptical of returning to the office at any point. When adding up the pros and cons of remote work, it’s no contest. I’m getting to the point where I simply can’t imagine working from a central office ever again and would likely join the ranks of those prepared to find other employment if they are faced with being forced back to working at an office. Because of this potential, I’ve ramped up my early retirement planning and am evaluating what options are available to me should I be faced with an ultimatum to return to the office within the next year. My situation is also unique because I moved a thousand miles away from the office during the pandemic, so returning to the office would mean moving again.

In the meantime, I am maintaining as high of a savings rate as possible in order to put myself in the best possible financial position when/if the time comes to make that difficult decision. One of the most significant benefits of having a sizeable nest egg and emergency fund stashed away is being able to put yourself first when making these decisions, or as others say, having “F-U” money. I remember when I didn’t have any savings and I was tethered to my job in order to pay for necessities and I don’t ever want to be in that situation again if I can help it.

Leave a Reply