It’s hard to believe we are already beginning 2022. 2021 was a year I’m sure a lot of us would like to quickly forget so we can move on to bigger and better things. Despite all of the challenges that 2021 brought with it, equity markets performed strongly with the S&P 500 growing by nearly 27%. Along with the strong stock market growth rate, we saw the Consumer Price Index rise by 6.9% for the 12 months ending November 2021, the largest increase in several decades. Thankfully, I am not in the market for a used car or many of the other items in the CPI basket that increased significantly so I am not impacted by the price growth as much.

Net Worth = Assets minus Liabilities

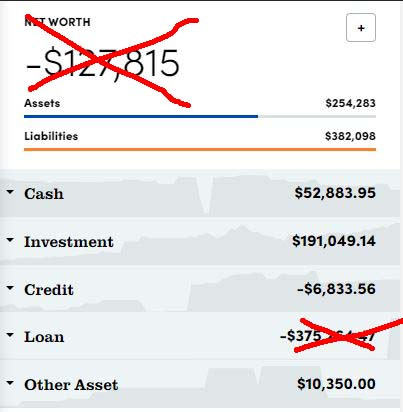

I track my net worth using Personal Capital, but a funny thing happened right at the end of the year. My stated net worth number plummeted to negative $127,815, which was a big surprise to me since it was positive $54,772 last month! It turns out there was a massive increase in the loan category, specifically my student loans. Several weeks ago I filed paperwork to consolidate my federal student loans to take advantage of the Public Service Loan Forgiveness Temporary Waiver that entitles me to additional payment credits on loans that were previously ineligible for credit.

What happened though is that my loan servicer added the new consolidation loan to my account but has still not removed the old loan balances that have now been consolidated, effectively doubling my outstanding student loan debt. My servicer assures me this will correct itself within a couple of months, but in the meantime my Personal Capital net worth numbers are going to be incorrect. I’ll also be writing a post for the blog about this student loan consolidation process as it is a great limited time opportunity for those working in public service to take advantage of.

| Assets | Amount | Change from Last Month |

| Checking/Savings | $52,884 | |

| Retirement Accounts | 173,164 | |

| Taxable Investments | 17,885 | |

| Misc. (Gold/Silver/Cash/Collectibles) | 10,350 | |

| Total Assets | 254,283 | -21 |

| Liabilities | Amount | Change from Last Month |

| Credit Cards | $6,834 | |

| Student Loans | 191,669 | |

| Total Liabilities | 198,503 | -1,029 |

*These values have been corrected to reflect the actual student loan balances.

Net Worth = $55,780

Change in Net Worth from last month: +$1,008

Total Change in Net Worth Since July 2020: +$104,008

Net Worth Summary

I hit a couple of important financial milestones in 2021 including achieving a positive net worth, after starting this journey with a negative $48,228. In addition to achieving a positive net worth, I crossed the threshold of $100,000 in cumulative net worth growth in December of 2021.

While the stock market performance was responsible for some off this growth, much of it was the result of aggressive saving and frugal living choices I made over the past 18 months.

Investment Returns

Over the course of 2021, my investments returned about 31%. This exceeded the S&P 500 return of 27% for the year. While my work-based retirement account is invested in low cost mutual funds, my other accounts are self-directed and contain individual company shares and a Vanguard dividend growth fund.

2021 Budget Results

The budget tool at Mint.com is useful in tracking my spending from month to month. Let’s take a look at what it shows for the entire year of 2021. I ended the year with $25,200 left over from my income minus expenses, effectively that is savings. What this doesn’t show is my pre-tax retirement savings contributions that are not included in my paycheck number. If we add in the $19,500 maximum contribution I made in 2021, plus the employer match of approximately $4,300, this means I saved around $49,000 over the year. This is a savings rate of approximately 57%, exceeding my goal of a 50% savings rate!

One reason for achieving this goal is that my federal student loans are currently paused by the government amidst the ongoing Covid-19 pandemic. Once those payments restart, they will consume 10% of my “discretionary income” as calculated by the department of education. It’s possible that this would still allow me to achieve a 50% savings rate overall, but just barely. Another reason was my decision to relocate to a lower cost of living area during the ongoing pandemic.

Retirement Savings Goal

My current retirement savings goal is $650,000. My hope is to retire early to a foreign country with a lower cost of living to make this $650,000 more than sufficient to support my spending for the remainder of my life. While I do expect to continue earning some income along the way, I am setting my goals based on a complete cessation of earned income. I set a target date of the end of 2029 to achieve this goal and keep track of it within Mint. This tool has estimated I am 9 months ahead of schedule with achieving my savings goal. It appears that the balance does not include some of my investments so it is likely that I am more than 9 months ahead at this point.

Financial Goals For 2022

- Max out employer-sponsored retirement account ($20,500 for 2022)

- Max out IRA ($6,000 for 2022)

- Max out HSA ($3,650 for 2022)

- Increase spending in areas that bring personal enjoyment

Leave a Reply