I previously posted about my starting net worth and will now dive into my current monthly budget and the plan for the remainder of the year. Starting with the income side of the equation, I have two jobs, a primary full-time salaried job and a part-time hourly side hustle (and now this blog as a second side hustle). As a young professional in an expensive city, it has seemingly become normal to have not just one, but two jobs to try to get ahead. The combined gross income from these two jobs is about $90,000. Compared to the median household income of $85,203 in Washington DC, I am just slightly above the middle of the income distribution, by working two jobs.

Cost of Living in Washington, DC

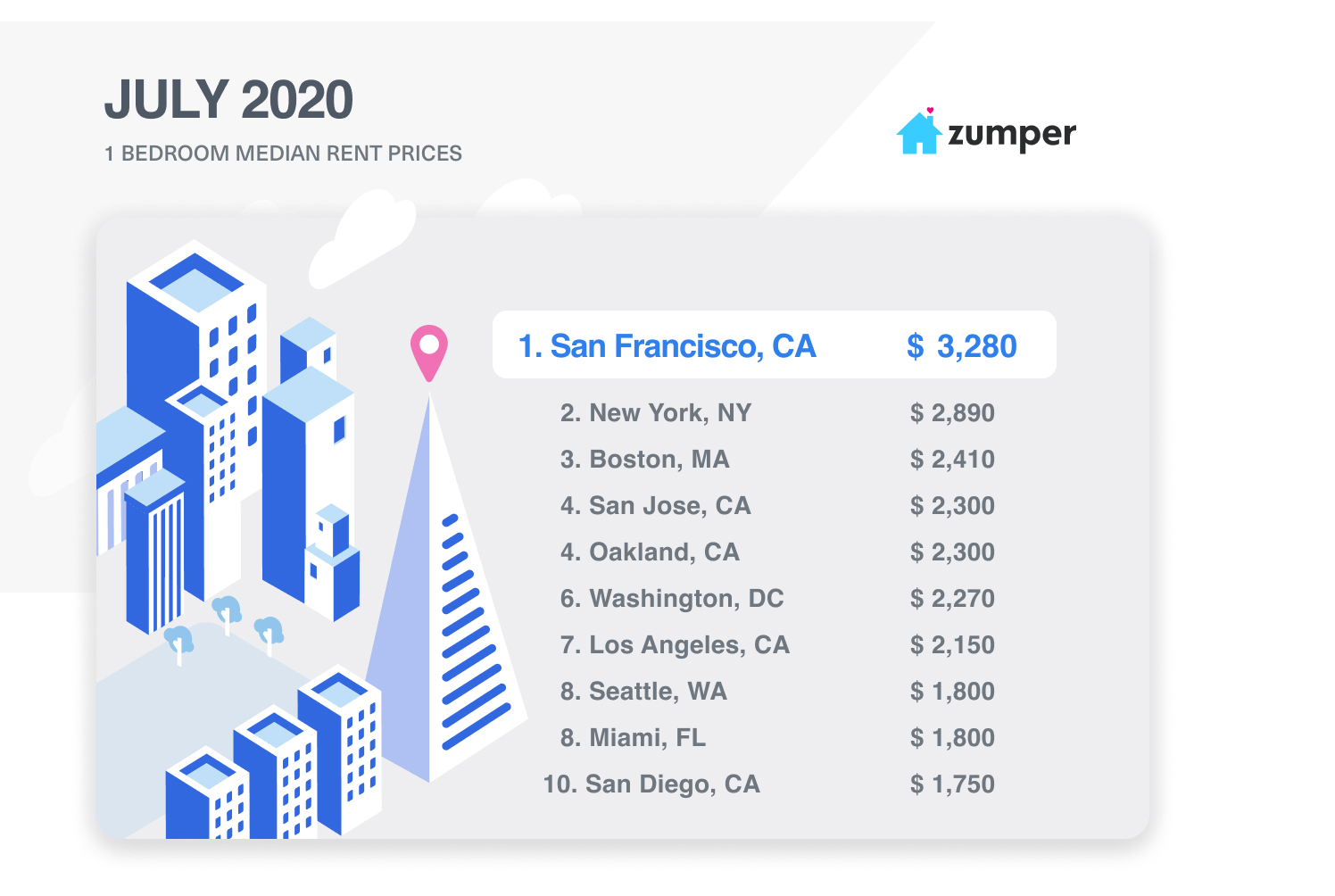

According to Zumper, Washington DC is the 6th most expensive rental market in the United States.

With a median price of $2,270 for a one-bedroom apartment, DC is a difficult place to start out as a single recent college graduate or a Capitol Hill intern. But once establishing yourself in the area and seeing your income move up, it becomes a little bit easier to afford. There are also things that can be done to find good deals on rentals and other considerations to lower the cost of living in the Nation’s Capitol.

Budget Tracking

While I use Personal Capital for tracking my net worth, I also use Mint as a budgeting tool. The Mint platform provides a lot of great tools to track your spending and make budgeting a breeze… and it’s free! For the month of June I set a $3,000 budget spread across 10 categories. Let’s take a look at my June 2020 budget on Mint:

The first thing I’ll note is that June was one of the two months this year in which I had three bi-weekly paydays for my full-time job instead of two, so the paycheck figure is normally about $2,000 lower. This category includes the net pay I receive from my paycheck and already excludes the taxes, insurance withholdings, retirement contributions, etc. The Other Income category includes a $300 bank account signup bonus I received. Stay tuned to The Money Sloth for more posts about how to make some extra cash by signing up for bank accounts and other services; I regularly make a few thousand dollars per year with these free money hacks.

Budget: Rent

Obviously, the largest budget expense each month is rent. My water and trash is included in the bill I receive from the rental company each month which usually hovers around a total of $1,550-1,600/month all-in. June’s rent was decreased slightly due to a law that was passed in DC that required landlords to refund our amenity fees as a result of the amenities being closed during the worst of the COVID-19 pandemic. Normally, my rent consumes about half of my monthly budget and 21% of my gross income; it is recommended that you spend no more than 30% of your income on housing and if it weren’t for me finding the great apartment deal that I did, my ratio would be right at that 30% of gross income figure. Housing costs are a huge opportunity to find savings in your budget if you can shop around for the right deal.

Budget: Food & Dining

The next highest spending category for me is usually Food & Dining, but a wonderful thing has happened during the pandemic… my expenditures in this category have plummeted. Working two jobs led to a habit of grabbing takeout lunch and dinner out of convenience and that spending certainly added up (and often exceeded my $450 budget). However, now that I am working from home, the opportunity for grabbing takeout meals has completely dried up resulting in this significantly reduced spending on food and dining.

Budget: Bills & Utilities

Bills & Utilities primarily include electricity, internet, Sling TV streaming, and cell phone service. The other categories are rather self-explanatory and the reason for the negative number in health and fitness is because of the way I choose to recognize reimbursements from my Flexible Spending Account for healthcare costs. In this case, I incurred healthcare expenses in May, but the FSA reimbursement didn’t come through until July, so it looks negative here but is offset by positive numbers in that category in the previous month.

Budget: What’s Missing?

You may notice that my budget doesn’t include any spending for transportation in June. For starters, I am car-less. One of the benefits of urban living is the lack of need for a vehicle. I can walk to the pharmacy, grocery store, doctor, and countless other establishments; besides, finding a place to park in DC is a nightmare and I don’t need that additional stress in my life!

When running the numbers on where to live in the DC Metro area, many of my colleagues thought I was crazy to pay higher rent in the city (at the time my rent was nearly $2,000/mo for a studio), instead of moving to where they live about 30-40 minutes away and save $500/mo on rent. I’ll have a future post here about the cost/benefit analysis of having a car in the city and why it is actually cheaper to pay more in rent to live in the city. Due to the pandemic and the mandatory work from home status of my employer, I am also not traveling to and from the office and generally staying home or utilizing free modes of transportation such as walking or a bike share membership I pay $29/year for.

Budget: Changes

June was a very frugal month as the pandemic continued and my spending was restrained because of staying home. Based on the numbers in June, I had net income of $6,533, spending of $2,084, for a total of $4,449 leftover. Obviously, this is an anomaly because of the extra paycheck this month, so if we take that out and assume a normal $3,000 monthly budget, my typical leftover amount should be around $1,450.

As discussed in my first Net Worth post, there are some changes that I need to make to my retirement savings in 2020. I’m currently contributing only $165 per paycheck into my retirement account in order to get the full company match, but I am going to increase this amount for the last ten paychecks of the year in order to max out my retirement contributions at $19,500. This increase will reduce my monthly take home pay by about $2,150 per month (this is a good reason to set your retirement contributions at the beginning of the year to spread them out evenly versus having a huge hit later in the year). While the $2,150 per month decrease in income will put my budget in the red, since my typical leftover amount is only $1,450, I am able to do this by covering the shortfall with the excess in my emergency fund. By doing this, I am also able to take advantage of the tax benefits of maxing out my retirement account, with my marginal tax rate being 30.5%, that means for every $1,000 more I contribute to my retirement account, I reduce my taxes by $305.

If everything goes as planned, I’ll have to draw down my emergency fund by $700 per month ($2,150 shortfall minus $1,450 usual budget surplus) for the remainder of the year. These retirement contribution changes begin in August, so that means five months multiplied by $700 will draw down my emergency fund by $3,500.

Stay tuned to The Money Sloth for future budget and net worth updates as well as money tips and tricks. Follow along as I climb out of the negative net worth hole that I dug myself into after accumulating six-figures in student loan debt.

2 Comments