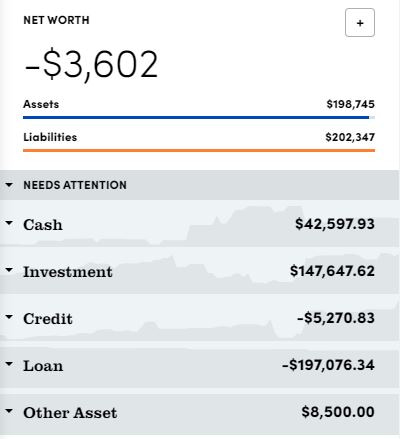

It’s been a little while since I have written a net worth update post, although I continue to keep the Money Sloth Net Worth Tracker on the right side of the homepage up-to-date. The April 2021 Net Worth Update is so close to getting back to zero and you can see below how the numbers add up. The graphics are all from my Personal Capital account and I highly encourage you to consider signing up for your free account in order to more easily track your net worth and monthly expenses.

Net Worth = Assets minus Liabilities

| Assets |

Amount |

Change from Last Month |

| Checking/Savings |

$42,597 |

|

| Retirement Accounts |

143,000 |

|

| Taxable Investments |

4,647 |

|

| Misc. (Gold/Silver/Cash/Collectibles) |

8,500 |

|

| Total Assets |

198,745 |

+6,723 |

| Liabilities |

Amount |

Change from Last Month |

| Credit Cards |

$5,270 |

|

| Student Loans |

197,076 |

|

| Total Liabilities |

202,347 |

+1,257 |

Net Worth = -$3,602

Change in Net Worth from last month: +$5,466

Total Change in Net Worth Since July 2020: +$44,626

This update brings my net worth very close to finally hitting break-even! Considering I started this journey on The Money Sloth with a starting net worth of -$48,228 in July, 2020, I am very pleased with the progress being made so far. As I mentioned in my last post, I applied for a student loan refinancing for my private student loans in the month of March that will be funded by the beginning of April. This refinancing will bring my interest rate and payment amount down each month, while the vast majority of my student loan debt continues to consist of federal loans that are in a 0% pandemic forbearance that also does not require repayment at this time. These federal student loans are currently included in the Public Service Loan Forgiveness (PSLF) program and are expected to be forgiven after I complete 120 months of repayment while working at a qualifying employer.

My financial plan in 2021 is much the same as in 2020 with a goal of maxing out my employer pre-tax retirement account and Roth and traditional IRAs. That should equal out to about $30,000 in retirement savings contributions in 2021 when including the employer matching.

Leave a Reply