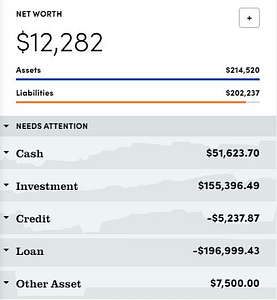

This marks the third month in a row that I have maintained a positive net worth! I started my FIRE journey exactly one year ago with a net worth of -$48,228. Today, I can report that my net worth has increased by $60,510 over the past 12 months. This is an average increase of $5,042.50 each month. Never in my wildest dreams did I expect to see so much progress within the first year! While the stock market has contributed to some of this increase, a lot of it can be attributed to achieving a 50% savings rate.

Starting The Money Sloth blog has helped keep me accountable for documenting my progress and gotten me more involved in the online Personal Finance and FIRE communities. This has led me to keep my spending in check and regularly increase my savings rate over the past year.

Some of my favorite PF bloggers who have helped keep me motivated include:

A Purple Life – Purple was the reason I decided to finally start blogging about my own financial journey. I was fascinated following her story of retiring early from her high-paying career and then witnessing the live-tweeting of her resignation. For anyone looking for a great example of the before and after of FIRE, check out A Purple Life for some terrific real-life stories. Now that Purple is embracing a nomadic retirement, it gives me something to strive for in my own early retirement plans.

The Fioneers – Jess and Corey started The Fioneers for the same reason I started The Money Sloth, to track their financial journey progress. Today, The Fioneers has a great catalog of award-winning content on their blog and is a great place to start for anyone interested in beginning their FI journey!

Gov Worker FI – Sam’s Government Worker FI blog is targeted toward federal government employees and is a great resource for breaking down the complex system of federal compensation and benefits and making it easy to understand. There are many unique financial challenges/opportunities for federal workers pursuing FIRE and this blog does a great job of showcasing them.

One Third of the Way to Financial Independence!

I currently have an FI goal of $650,000. This is derived from using a 4% withdrawal rate that will provide enough income to fully cover my monthly expenses. I plan to relocate to a much lower cost of living country once making the decision to “retire.” I expect to have additional bonus streams of non-employment income by the time I hit the $650,000 and also have a small pension and social security available to me in my early 60’s.

I currently have an FI goal of $650,000. This is derived from using a 4% withdrawal rate that will provide enough income to fully cover my monthly expenses. I plan to relocate to a much lower cost of living country once making the decision to “retire.” I expect to have additional bonus streams of non-employment income by the time I hit the $650,000 and also have a small pension and social security available to me in my early 60’s.

I use Mint.com to track this retirement savings goal and am currently on track to reach that target 9 months ahead of schedule in March 2029. You may notice that I basically ignore my current debt balance in my retirement savings calculation. The reason for that is because I am employed in a job that will provide tax-free public service loan forgiveness on my nearly $200,000 student loan balance around 2029. The expected 2029 timing of hitting my savings goal combined with the forgiveness of my student loan debt will make 2030 an ideal year to start my early retirement in my mid-40’s.

By discounting the $196,999 in student loans, I am left with an adjusted net worth that is about 30% of the way toward my goal of $650,000 for early retirement!

Net Worth = Assets minus Liabilities

| Assets |

Amount |

Change from Last Month |

| Checking/Savings |

$51,624 |

|

| Retirement Accounts |

148,479 |

|

| Taxable Investments |

6,917 |

|

| Misc. (Gold/Silver/Cash/Collectibles) |

7,500 |

|

| Total Assets |

214,250 |

+1,655 |

| Liabilities |

Amount |

Change from Last Month |

| Credit Cards |

$5,238 |

|

| Student Loans |

196,999 |

|

| Total Liabilities |

202,237 |

+593 |

Net Worth = $12,282

Change in Net Worth from last month: +$1,061

Total Change in Net Worth Since July 2020: +$60,510

Personal Finance Blogging

While the progress on my finances has exceeded expectations over the past year, the blogging side of it has not been as successful. First and foremost, I write The Money Sloth for myself to keep me accountable toward my financial goals. The second goal of The Money Sloth is to create a side-hustle income over time. The path to blogging success has been varied among many of those that I follow on Twitter, with some seeing publicity and blogging success within months of launching and others who blogged for years before soaring in popularity.

At times, I wonder if the popular line from Field of Dreams “If you build it, they will come” applies to blogging too. Naturally, the more (high-quality) content you build, the more readers you should attract. The only excitement I have had on the blog traffic front over the past year was the result of a bot attack in May. I had to quickly setup Cloudflare to defend against the havoc that was being directed my way. I still have no idea if that resulted in any sort of Google search penalty as the attack appeared targeted toward generating artificial Google search traffic.

Blogging Goals for the Next Year

Besides increasing my production of financial blog content, I plan to focus on Search Engine Optimization and link building over the next year to try to grow readership. Expanding social media activity to Pinterest is also something I need to work on to help build more blog traffic. I’m not sure what a good traffic target should be, so I think I’ll aim for 100 daily pageviews by July 2022.

Another goal I have is to be able to attend the 2021 FinCon in September. I think this would be a great way to continue networking within the PF blog universe and learn from those that have already found blogging success. I have a bunch of Amtrak points saved up, so I may take the train straight to downtown Austin. If you’ll be in Austin at the same time as FinCon, let me know if you’d like to meet up!

Way to go on blogging for a year. My blog took 2 years before anything happened. Hope to meet you at FinCon!

Thanks! I really hope to be able to make the FinCon scheduling work this year. I’ll reach out and let you know if I’m able to make it happen!