I remember listening to Dave Ramsey on the radio every weekday while folding pizza boxes in the afternoons when business was slow at the pizzeria I worked at. I can’t say I agreed with much of his financial advice, but it was good entertainment during these slow afternoons and also opened my eyes to other points of view when it comes to financial planning.

Well, Dave Ramsey has now gone viral on social media for saying during a Fox News interview that he doesn’t believe in the $600 and $1400 stimulus checks being sent to Americans in the midst of the pandemic-inspired crisis – “I don’t believe in a stimulus check, because if $600 or $1,400 changes your life, you were pretty much screwed already.”

“You have a career problem, you have a debt problem, you have a relationship problem, you have a mental health problem — something else is going on if $600 changes your life,” Ramsey continued.

At the very least, these statements are incredibly tone-deaf. No shit you have a career problem while we are in the midst of a pandemic and government health mandated industry shutdowns that have left tens of millions of Americans unemployed through no fault of their own!

Dave Ramsey teaches a financial methodology centered on debt elimination and not utilizing credit. But how many of his disciples were prepared for over a year of joblessness or reduced work hours? Ramsey’s own advice says to only have a $1000 emergency fund until you’re fully out of debt, and then only have 3-6 months expenses in it. Even followers of Ramsey’s own advice would likely be devastated by the damage caused by Covid-19 in the US if they worked in the hospitality or service industries and I’m sure they would see $600 or $1400 as a life changing thing if they are facing eviction, empty kitchen cupboards, or other disastrous impacts of the current crisis.

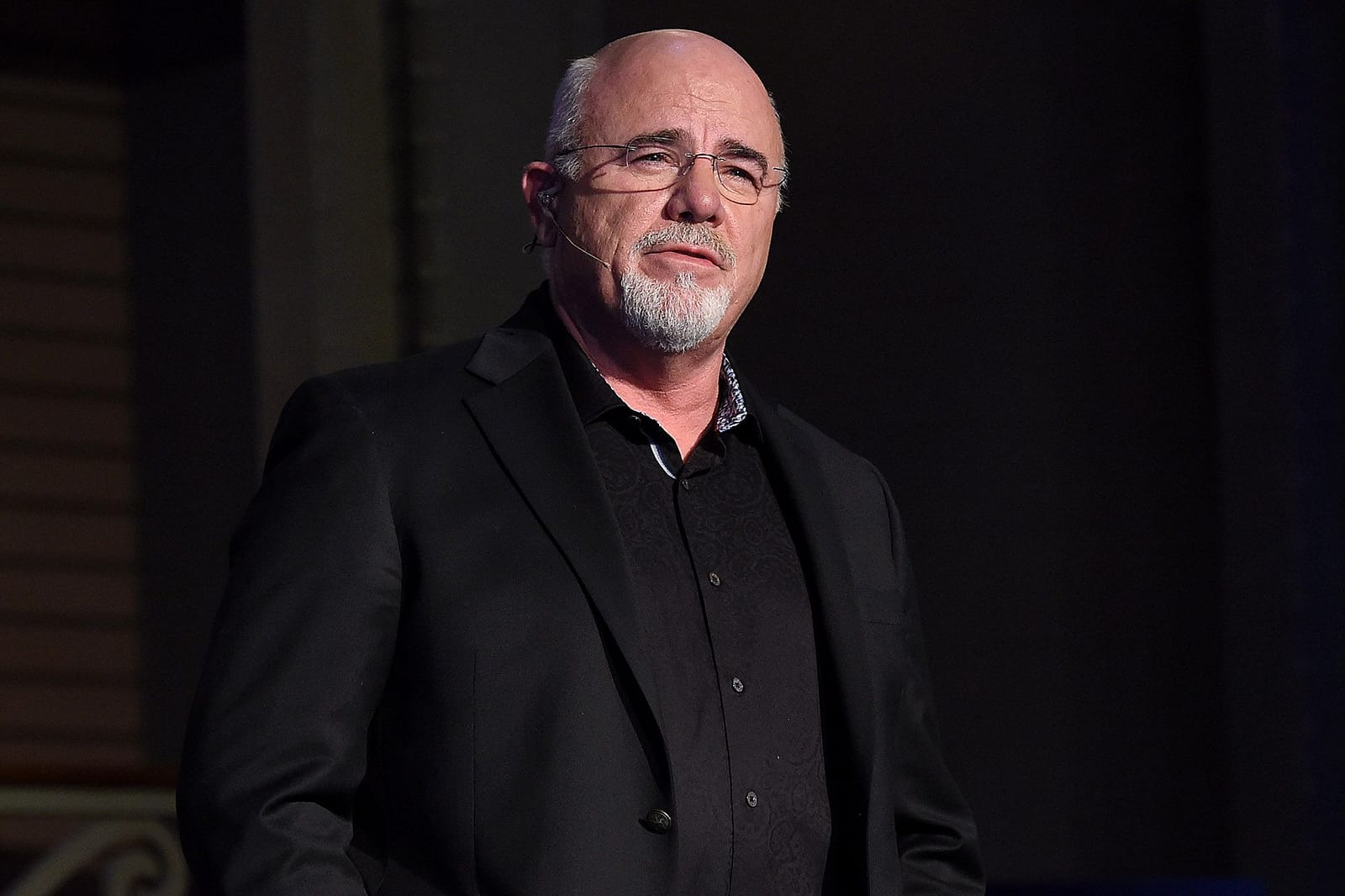

Perhaps the problem is that Ramsey has become too detached from the reality of poverty in America after amassing enormous financial success of his own. Here is Dave Ramsey’s house:

Someone with an estate like that probably pays over $600 per month on landscaping and gardening, so it’s no wonder that Ramsey thinks those emergency relief payments are not necessary. I suppose this opens up another question of whether financial advisers who become far removed from their “lean years” when they were just getting started, are still effective at understanding financial hardship and advising those struggling just to put a roof over their head and food in their mouths?

Leave a Reply