A recent article about Google search trends relating to the current housing market caught my attention. The search frequency for “When is the housing market going to crash” has increased almost 25x in the past month. Anyone who peruses Zillow, to either search for a home to purchase or just out of pure curiosity (I’m guilty of the latter), knows that home prices are spiraling higher in many markets around the United States. Not only are prices soaring, but it seems as soon as I see a house go on the market, there is a pending offer in a matter of days. Are we in a housing bubble?

Bidding Wars

Forget the anecdotal, let’s take a look at the data. In fact, CoreLogic reports that home prices are up 10.4% between February 2020 to February 2021. That’s the largest annual increase in 15 years! What is driving this increase in prices? It’s not the same driver we saw during the last housing bubble that spawned the book and movie, The Big Short. The 2007-2008 housing bubble was caused by risky lending practices and the so-called NINJA (No Income, No Job, Approved) mortgages. This time around, there’s no evidence these ultra-loose lending standards are causing the rush to buy housing. In fact, many buyers are all-cash or putting down 50%. That leads me to believe that the demand side of the housing market right now is being driven by investors and wealthier families, leaving many blue-collar working class households out of the market entirely as they can’t compete with all-cash or 50% down buyers.

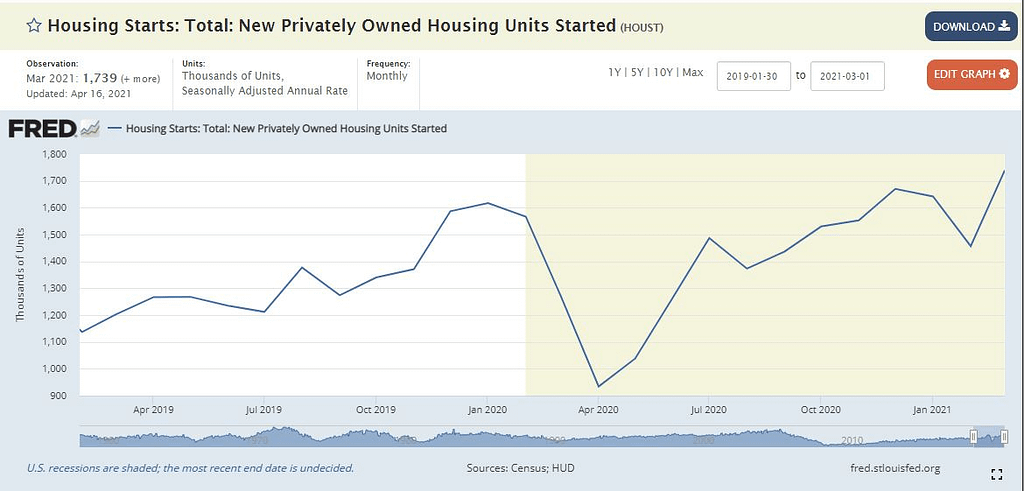

What does this mean for average Americans looking to buy their first home or upgrade to accommodate growing families? It’s not good. The reason for the price acceleration in housing appears to be driven by a lack of supply. This is surprising considering that new housing construction started in 2020 was 1.38 million units, an increase of 7% over 2019. It’s astonishing that despite the pandemic induced economic slowdown of 2020 that new housing construction still grew at such a rapid pace. Even more astonishing is that the level of new construction still wasn’t enough to satisfy the voracious demand from families and investors. Home builders are indicating that they could build more in 2021 if there were not material and labor shortages in numerous regions of the country, which are being attributed to ongoing pandemic disruptions in the supply chain.

There is story after story of working families getting outbid or an all-cash buyer being selected instead of them when trying to purchase homes in many markets. Buyers are even bidding five to six figures above asking and foregoing any inspections or contingencies. In fact, over a third of all homes sold in March 2021 went for more than asking price. This seems to be extremely speculative behaviour on behalf of these buyers and leaves them open to expensive surprises that a home inspection may uncover.

Does this mean we are in a bubble or just another housing bull market? It all depends who you ask. Billionaire real estate investor Jeff Greene thinks we are in bubble territory at current housing valuations and that 80% of the price growth is attributable to the amount of liquidity in the economy. He also surmises that significant inflation pressure is on the horizon. The opposing argument is that there is not a bubble, like the one we experienced in 2008, because lenders are not significantly loosening their underwriting standards. The question remains whether loosened lending standards are a prerequisite for bubble creation or if the flood of cash stimulus from the federal reserve is effectively having the same result, but benefitting the investor class.

Housing prices up, rent prices flat

An interesting phenomenon has been happening in big cities around the United States during the pandemic – collapsing rent prices for apartments. For example, in a Washington DC neighborhood that I am familiar with, rent prices for studio apartments have fallen from over $2000/month in mid 2019, to only $1150/month after incentives for move-ins occurring in the spring of 2021. This collapse in pricing has occurred as many households lost jobs in the service sector or decided to relocate to the suburbs as a result of the pandemic and the extended work from home status of many employers. This move to the suburbs has coincided with the increased demand for single-family homes as those who are working from home seek out more space to both work and live under the same roof. The overall rent prices across the country have remained steady because of the increased rent prices in the suburban areas offsetting the declines in urban centers as some remote workers choose to continue renting.

An interesting phenomenon has been happening in big cities around the United States during the pandemic – collapsing rent prices for apartments. For example, in a Washington DC neighborhood that I am familiar with, rent prices for studio apartments have fallen from over $2000/month in mid 2019, to only $1150/month after incentives for move-ins occurring in the spring of 2021. This collapse in pricing has occurred as many households lost jobs in the service sector or decided to relocate to the suburbs as a result of the pandemic and the extended work from home status of many employers. This move to the suburbs has coincided with the increased demand for single-family homes as those who are working from home seek out more space to both work and live under the same roof. The overall rent prices across the country have remained steady because of the increased rent prices in the suburban areas offsetting the declines in urban centers as some remote workers choose to continue renting.

Google has indicated that they want their employees back in the office by September 2021, which is the opposite of what other tech companies are committing to. Twitter has shifted to a remote-first workplace and is offering the option to permanently work from home for many of its employees. This contrast is being seen in other industries as well since some managers want everyone back in the office to maintain the pre-pandemic status quo while others are embracing a more flexible work environment. It seems the magnitude of the strength in the housing market could rely heavily on the decision made by employers around the country to either continue work from home or go back to requiring workers to report in-person in mostly urban core office buildings.

The future of remote work and what it means for housing

What I envision over the next few years is a radical shift in the choices that employees begin to make in which companies they want to work for and the wages those companies will have to pay to attract them. Companies that embrace a remote-first workforce will be able to attract top talent at a lower cost as those workers see immense value in being able to work from any geographic location they want. While companies that require in-office work in major urban centers will have to pay more to subsidize the extra cost and hassle associated with requiring workers to live in more expensive localities and pay for commuting (both in monetary terms and the soul sucking emotional toll of long commutes!).

As you may have noticed, I tend to prefer a remote work environment. Over the past year I have been working full-time from home because of the pandemic and I have found it to be an incredibly positive experience. My productivity is significantly higher and I have customized my home office setup to be much more efficient than my company issued equipment in the office. I am able to eliminate a long commute on public transportation in a major city that was costing me at least two hours per day of lost time. I’m saving a considerable sum on lunches during the week as well. I have not experienced any of the negatives that many of the long time managers at my company complain about like “losing touch with colleagues, losing company culture, and productivity issues.” In fact, I’ve told them repeatedly that remote work is what you make it and that if you see that you’re losing touch with colleagues it’s because you aren’t reaching out to them to talk! Pinging someone on Skype or Teams while remote working is the same as swinging by their office to check-in, yet some people seem to struggle with that social interaction via online messaging. Perhaps remote work isn’t ideal for everyone, but for those of us who are more effective working remotely, we may see more remote-first job opportunities in the future.

People like me will continue leaving major cities (and perhaps our current employers if we are forced back to the office in the future) and moving to other areas where housing is more affordable. This migration will continue to put upward pressure on housing prices in the suburbs as demand increases. Over time, if enough employers embrace full-time remote work, it could reshape the housing market for white collar workers and shrink the gap between rural and urban housing prices. The downside to this migration is that now these higher paid remote-workers will be causing price increases in communities that were previously home to mostly blue collar workers and begin pricing them out of the market. We have already seen the impact to first-time homebuyers in the current environment as investors snap up homes in all-cash deals.

Over the next year, Zillow expects home prices in the United States to increase by over 11%. For comparison, prices are up almost 10% in the past year. If we are in a housing bubble, it could still be a while before reaching the top. Therein lies the problem with calling a bubble, you won’t know where the top is until it’s too late and prices have already fallen.

1 Comment