Today, the Biden administration announced a ban on imports of Russian oil to the United States as a result of increasing sanctions against the Russian Federation for the unlawful war against Ukraine. Without getting into the politics of the decision, or minimizing the unbearable pain being suffered by the Ukrainian people, just how much of an impact will banning Russian oil have on the price of oil and gas in the United States and other countries around the world.

First let’s take a look at what the typical price of a gallon of gas in the United States is comprised of:

- Crude oil

- Refining costs/markups

- Distribution costs/markups

- Taxes (Federal/State/Local)

Obviously, the price of crude oil is the largest cost component in a gallon of gasoline in the United States. There’s 42 gallons of crude oil in a single barrel and it produces around 32 gallons of different fuel types and then the remainder is turned into other oil-based products. The U.S. Energy Information Administration has a neat graphic that shows the approximate percentages that each stage of production uses up.

Assuming these percentages stay close to constant, the increase in the price of crude oil is responsible for about 56% of the total cost at the pump. West Texas Intermediate oil prices have risen from around $60 per barrel a year ago, to over $127 per barrel today. That’s more than double the price in a year, and the jump in price from $90 to $127 has happened in the last couple of weeks. So we know that the spike in crude is directly causing the rise in gas prices paid at the pump. But how much Russian oil does the United States import into our oil refining industry?

Russia only supplies about 8% of the United States’ oil each year. This is behind Mexico (8.4%) and Canada (51.3%). The Russian imports amount to about 670,000 barrels of oil per day, which is the same as the amount of oil produced by the states of Colorado and Wyoming or 13% of the total daily production of Texas. The Biden Administration has already announced a 30 million barrel release from the National Strategic Petroleum Reserve, which is equal to 44 days of Russian oil imports.

Even though Russia makes up a small amount of United States’ oil imports, the optics of an import ban will continue to have an outsized impact on the price of crude oil in the marketplace. This oil is also used primarily by refiners without direct connections to pipelines, along the west and east coasts of the United States. These refiners can quite easily shift their deliveries to alternative points of origin as long as it can be delivered by ship.

Household Gasoline Expenses

Now that we’ve looked at what goes into a gallon of gasoline and where that oil comes from, let’s take a look at how American consumers use gasoline in their household budgets and what impacts can be expected from these price increases. Americans have been using less gasoline per household for years now and based on 2020 figures of 123 billion gallons of motor fuel consumed in the American economy, divided by the 130 million households, we get an average annual household share of consumption of 946 gallons. Now, it’s true that some households drive more and some drive less but we can look at this average to calculate the impact on the typical household budget.

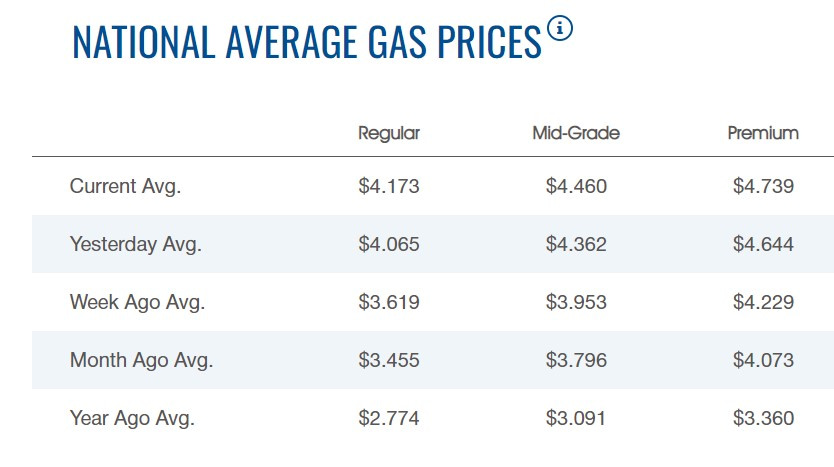

AAA reports that the average price of regular gasoline is $4.173 today and was $3.455 one month ago. Much of this price increase aligns with the timing of growing tensions and then the invasion of Ukraine. Assuming prices stay where they are now for the next year, the average household will see an additional expense of $679 for gasoline, or $56 per month. Many analysts expect prices to continue rising, so let’s think about how much of an impact there is to the typical household expenses for each $1 increase in gasoline prices:

Average Household Monthly Expense Increase Per Dollar Increase in Gasoline Prices

$1 increase = $79/month

$2 increase = $158/month

$3 increase = $237/month

As households are already stretched thin by rising housing, car, and energy prices in general, the possibility of another $150-250 per month in gasoline expenses could be the breaking point for many lower income households who are most hurt by increases in housing, energy, and food prices. The American Council for an Energy-Efficient Economy recently released an analysis that showed gas prices consume almost 14% of low-income household budgets versus just 4% of higher-income households – and that’s when gas prices were much lower than they are today.

How to save money with high gas prices

Unfortunately, that extra gas money has to come from somewhere. There are only two options in situations like these and they are to increase your income or decrease expenses (or reduce savings). Nobody likes to hear that, but it’s the unfortunate truth in these situations. Finding an extra $200 per month isn’t necessarily easy, but some places to find savings could include re-evaluating spending/saving in the following areas:

- Reduce unnecessary driving by combining trips (best way to lower gas expenses)

- Dining out ($15-25/meal)

- Switching from Cable to SlingTV ($40/month savings)

- Switching from traditional cell phone carrier to Mint Mobile ($40/month/line savings)

- Couponing/Ibotta ($20+/month)

- Switch to generic brands for some items ($20+/month)

- Swagbucks ($20+/month)

- Refinance Student Loans/Mortgage/Car Loan ($ varies)

- Cancel underused monthly subscriptions ($20+/month)

- Cut back on soda/alcohol ($50+/month)

- Transfer interest-bearing credit card balances to 0% APR promo ($ varies)

- Shop around for lower insurance rates (car/home/life) ($ varies)

- Redeem credit card rewards points

- Sell items you don’t use

If all these still don’t cover the monthly shortfall, then you may need to consider trimming back on 401k contributions (provided you continue to take advantage of any employer match) or deferring those (or IRA) contributions until later in the year when gas prices will (hopefully) be less impactful. As a last case scenario, picking up extra hours from an existing (or new) part-time job may be necessary. Again, nobody likes this answer, but it’s the sad reality of life in America for far too many households. I spent many years having to work multiple jobs in order to cover expenses and/or boost savings and wouldn’t be where I’m at today had I not done so when times called for it.

Nobody can be sure how long these economic sanctions on crude oil will remain in place, but it is probably a smart idea to explore some of the more mid to long term budget adjustments recommended above in order to weather this storm.

Leave a Reply